Start SIP To Invest In Best Mutual Funds 2023

Mutual fund

Mutual fund is kind of an investment vehicle that contain different type of asset classes. Depending on the assets in the portfolio, there are different types of mutual funds like gold, stock, bonds etc. If investor invest in mutual fund scheme, investors are contributed in short amount of money as well as big amount of money to buy an asset, gold, stock, bonds, commodities and many more. Basically, mutual fund is a type of investment in any company that collects a large amount of money from so many investors and pool it together in a pot and Mutual funds are managed by fund manager.

Lumpsum/one time investment: Lumpsum is the traditional mode of Mutual funds investment. It is best for who has a bulk amount to invest. And in future it will give good return to all investors in long term investor.

Systematic investment plan/SIP: mutual fund is kind of investment mod. And currently in this time systematic investment plan/SIP is a popular mode of investment. In this investment we can invest small amount and large amount as well on regular bases. And investment amount start will be Rs. 500/

Benefits of the mutual fund

There are so many benefits and advantage in mutual fund. some are like –

Risk Diversification: In mutual fund Risk diversification is one of the most prominent advantages of investing in mutual funds. In mutual fund buying shares is an easy way to diversify your investments across many securities and asset categories like debt, equity, and gold as well.

Professional Management: In mutual fund investor may not be have a proper time or required acknowledge and any kind of resource to conduct their purchase induvial. But mutual fund is managed by full time professional fund manager they have the experience, expertise and resource as well to manage all the buy, sell and monitor investments. fund manager all the time regularly monitors investments and rebalances all the portfolio accordingly to meet the scheme’s objectives. One of the most significant benefits of mutual fund is all the Portfolio management and monitor by professional fund managers.

Interval funds: in Interval funds investors can do both things these funds have of both features open-ended funds and closed-ended funds as well. And also, these funds open for subscription during certain intervals only.

Low Cost: In mutual fund Low cost one of the most important advantages of mutual funds. Mutual funds schemes have a low expense ratio, Due to huge economies of scale. In this fund Expense ratio will be represents the annual fund operating expenses of a scheme, and expressed as a percentage of the fund’s daily net assets as well.

Higher returns: Higher returns is one of the significant benefits of a mutual fund. If you invest in mutual funds, it will offer better returns compared to other deposits such as Recurring Deposits (RDs), Fixed Deposits (FDs) and many more. And also, Equity mutual funds present a good opportunity to investors to enjoy higher returns but at the same time it will accompanied with high risks and as well as idea for investors with a high-risk appetite.

Mutual fund based on structure

Mutual fund structure based on Open-ended, Close-ended and Interval Schemes as well. And an investor can spend his investment between in three mutual funds, according to their specific need and goal.

- Open ended funds: Base of open-ended fund, in this fund investor can buy all the funds as per as sell units on a continuous basis and, and also investors are able to enter and exit according to their convenience. These units are bought and sold at the net asset value (NAV) that declared by the fund.

- Close ended funds: In close ended funds investors not able to buy the units of a closed-ended fund after its NFO period is over. And also, existing investor of close ended funds they are not able to exit till the term of scheme of the funds will be ended. the term of the scheme will be end and also new investor also not able to enter in the scheme as well. Basically, it provides a kind of platform for investors to exit before the term will be end. and also, the fund houses list their closed-ended schemes on a stock exchange as well.

- Interval funds: in Interval funds investors can do both things these funds have of both features open-ended funds and closed-ended funds as well. And also, these funds open for subscription during certain intervals only.

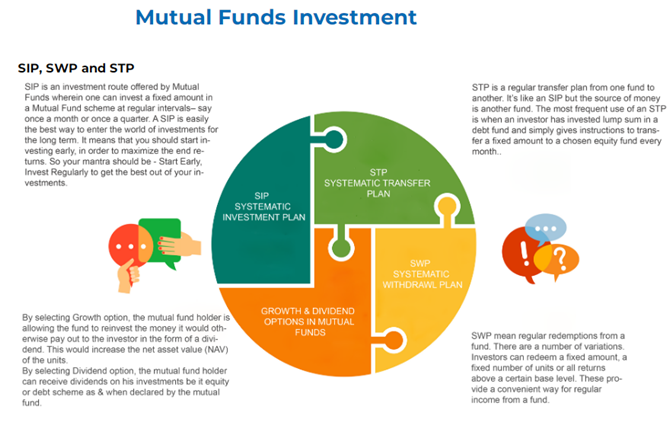

SIP, SWP and STP

Kindly Go Through This Website To Get More Information About Insurance Policy And Investment Plans : https://tulsiwealth.com/mutual-funds-investment.php

You May Also Contact With Us Further Inquiry :

Name : Mr. Rakesh Agrawal

Contact No : +91 7210105400 , +91 9910105400

Email Id : info.tulsiwealth@gmail.com

Website : https://tulsiwealth.com/

.png)

.png)

Comments

Post a Comment