Mutual Fund investment Plan & Benefits of Mutual Funds

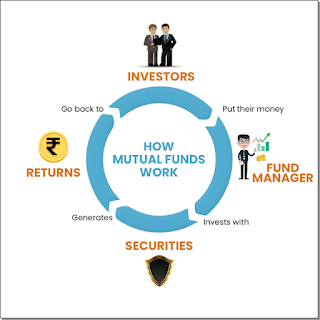

A mutual fund is "a pool of funds from a large number of investors who have a common investment objective". It is professionally managed by the "Fund Manager". The fund manager invests the fund in various securities i.e. stocks, bonds, and money. Market instruments and other securities. Investors who invest in mutual funds are known as mutual fund "shareholders (or) unit holders". The mutual fund company allows units to the investors in proportion to their investment amount. Mutual fund investment is the best way of investment for those who do not have proper knowledge about the stock market. It allows small investors to invest in mutual funds with just Rs.500/-. When investing, many investors look for the "right time" to start and stop investing in order to earn a higher rate of return. In investing, there is a saying that "the right time to invest is now", which fits well for an investor who is in the process of building wealth