Mutual Fund investment Plan & Benefits of Mutual Funds

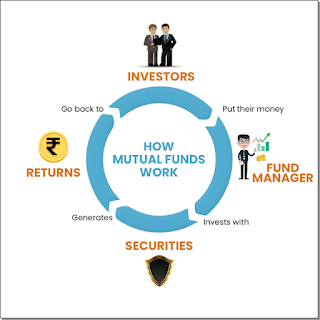

A mutual fund is "a pool of funds from a large number of investors who have a common investment objective". It is professionally managed by the "Fund Manager". The fund manager invests the fund in various securities i.e. stocks, bonds, and money. Market instruments and other securities.

Investors who invest in mutual funds are known as mutual

fund "shareholders (or) unit holders". The mutual fund company allows

units to the investors in proportion to their investment amount.

Mutual fund investment is the best way of investment for

those who do not have proper knowledge about the stock market. It allows small

investors to invest in mutual funds with just Rs.500/-.

When investing, many investors look for the "right

time" to start and stop investing in order to earn a higher rate of

return. In investing, there is a saying that "the right time to invest is

now", which fits well for an investor who is in the process of building

wealth or achieving his financial goals.

Mutual funds that deliver high returns on a consistent basis

across market cycles are considered as the best performing mutual funds in

India as they have shown the potential to earn better returns.

Achievement of

Financial Goals: Investors who want to meet their investment goals should

invest in top mutual funds as per their needs. Investing in top mutual funds,

which have consistently delivered better returns than their peers, will help

investors achieve their goals faster.

People who want to

invest regularly: Through SIP, you can invest in top mutual funds on a

regular basis, i.e. on a monthly, weekly, or quarterly basis. You can invest in

the best SIP mutual funds to realize your investment goals. You can start

investing in mutual funds with an amount as low as Rs 100 per month through SIP

in any of the best SIP plans in India.

Better returns than

traditional savings options: Traditional savings options offer a guaranteed

rate of interest. However, since it is almost risk-free, the returns from these

savings options are also muted. Even then mutual funds can't guarantee returns.

However, it can generate higher returns than traditional savings options like

bank fixed deposits.

In addition, different types of mutual funds have different

risk-return profiles. So, if you want to invest in high-return mutual funds

that offer the best returns, you may have to be prepared to take on a higher

risk.

Expert Wealth Management: Fund managers are professionals

who manage mutual funds. Their job is to select the best stocks or debt

instruments that can help the fund generate high returns and meet its

objectives. Hence, individuals looking for expert fund management can invest in

these top mutual funds.

Diversification:

Depending on the type of fund, the best-performing mutual funds invest in a

basket of securities that help in achieving diversification irrespective of the

investment amount. Diversification minimizes the negative impact of the poor

performance of a single (or a few) investment security on the overall portfolio.

It helps investors to achieve a consistent return on

investment and better portfolio performance. As a result, investors can earn

better average returns.

Are you looking for The best mutual funds investment? The

top ten mutual funds or the best mutual funds to invest in now will depend on

your financial goals, risk tolerance, and investment tenure.

Visit For

More Info:- https://www.tulsiwealth.com/mutual-funds-investment.php

Website:- WWW.tulsiwealth.com

Address:

- 21/4, Chhoti Subzi Mandi, B Block,

JanakPuri, New Delhi- 110058.

E-mail :-

info.tulsiwealth@gmail.com

Contact no.

:- 9654530807

.png)

.png)

Comments

Post a Comment